Imputed Income Setup

The life insurance benefit code includes the rate the employer is paying to cover the employee. It also can control the calculation for the employee’s imputed tax. The employee only is taxed for a portion of the premium, based on the employee's age and salary. To obtain this calculation, the system uses a combination of the following three areas:

- Employee’s age, pay rate, cycle hours, and pay group from the employee record.

- Benefit code Imputed Income Setup fields on the Benefit page in Maintenance.

- Life Insurance Step Setup and the Imputed Income fields on the Calculation Control page in Company HR Settings.

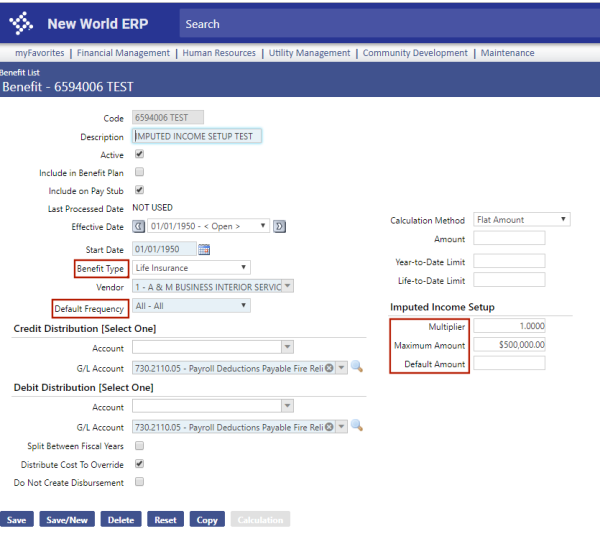

Maintenance>Human Resources>Deductions and Benefits>Benefits

- Benefit Type: Life Insurance (This selection displays the Imputed Income Setup fields.)

- Default Frequency: 1st check only is monthly (12 payments per year)

- Multiplier: usually 1.00. (This selection can affect the calculation of imputed income, where 1 is considered 100% of the calculation.)

- Maximum Amount: Amount of salary subject to the imputed income calculation

- Default Amount: Used in place of the first two fields

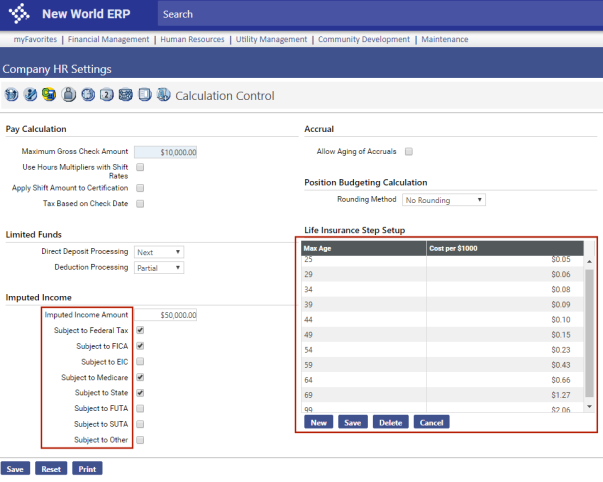

Maintenance > Human Resources > Company HR Settings > Calculation Control Tab

- Imputed Income Amount: Normally set to $50,000.00 to reduce amount from Projected Annual Salary prior to calculation

- Subject to taxes: Gross base of selected taxes will be increased by the amount of the calculation

- Life Insurance Step Setup: Table is the monthly rate from the IRS and has not been changed for at least 10 years. Max Age is the ceiling, meaning someone under 25 is calculated at $0.05.

Note: The IRS determines these rates. You may verify current tables with them.

- Earnings Register is the only place to see calculation.

- System does not look at actual dollars calculated in the payroll. Pay Rate * Cycle Hours * Pay Group settings (bi-weekly = 26, weekly = 52, etc.).

- Setup does not change if Benefit Plan is used.

- System rounds the employee’s salary to the next $1000.

- ImputedIncome = @CostPer1000 * (@PolicyAmount - @ImputedIncomeSystemSetting)/1000) * 12/(If the benefit frequency is monthly then 12, else @NumberOfPaymentPerYear).

- Regarding @NumberOfPaymentPerYear, we do not have custom code to obtain the number of payments per year; we only check the frequency for 1st check of the month, which will be 12. For anything else, we use number of payments determined by vsPayGroup.

- E.g., Employee's bi-weekly projected annual wages are $154,349, and the employee is 50 years old ($.23 per thousand). The calculation SHOULD be as follows:

155,000 - 50,000 = 105,000

105,000/1000 = 105

105 * .23 * 12/12 = $24.15

- A person with two departments will total annual pay prior to calculation.

- You must re-validate payroll if any change is made, even though system does not provide a warning.

- You cannot change the imputed income amount ($50,000) if the payroll is in process.

If set up in the benefit code, it does not give you the option of how to round the calculation; therefore, it is rounded by default:

(HOURLY PAY RATE) * (CYCLE HOURS) * (IMPUTED INCOME MULTIPLIER ON BENEFIT CODE) = (X)

ROUND (X) TO THE NEXT THOUSAND (So 53500 would be rounded to 54000)

((ROUNDED X) – 50,000)/1000 * 12/26 = AMOUNT PER PAY PERIOD

Client with Dependent Care Life Insurance, which is also taxable:

Set up a life insurance benefit code for 1.5x the client's annual salary.

Set up a separate life insurance benefit code for the default amount of 6500.

Calculation is as follows:

(HOURLY PAY RATE) * (CYCLE HOURS) * (IMPUTED INCOME MULTIPLIER ON BENEFIT CODE) = (X)

ROUND (X) to the NEXT THOUSAND. You also must run the 6500 to the next thousand so it is 7000.

((ROUNDED X) + 7000 – 50,000)/1000 * 12/26 = AMOUNT PER PAY PERIOD

Note: This will work only if the frequencies are the same.